You have to make a plan before you make a purchase.

Whether you’re buying your first or your twentieth investment property, finances and operation processes have to be in order. So, when you decide it’s time to buy, consider these key components of investment properties before you start the house hunt.

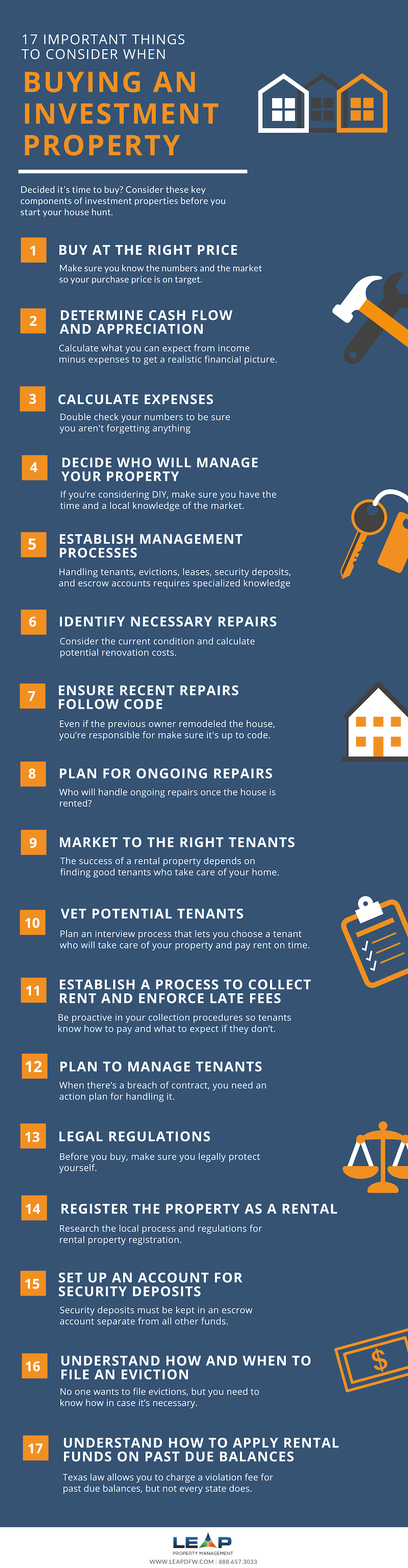

What to Consider Before Buying an Investment Property

1. Buy at the Right Price

As the investment proverb says, “You make your money when you buy, not when you sell.” Make sure you know the numbers and the market so that your purchase price is on target.

2. Determine Cash Flow and Appreciation

Monthly rent can be extremely lucrative if it brings in enough cash flow. So, calculate what you can expect from income minus expenses to get a realistic financial picture. (Check out this page for more info: Maximizing Rental Property Cash Flow)

3. Calculate Expenses

Not sure what numbers to include in your expenses? Check out this post to verify whether you’re forgetting anything!

4. Decide Who Will Manage Your Property

Will you manage the property yourself or hire a property manager? If you’re considering DIY, make sure you have the time and a local knowledge of the market. The right rental rate is key to the success of your property. Also, property management takes time. Plan to be on call 24/7 for repairs or tenant issues.

5. Establish Management Processes

Handling tenants, evictions, leases, security deposits, and escrow accounts requires specialized knowledge to ensure you stay within the law and manage your property professionally.

6. Identify Necessary Repairs

What initial repairs will you need to take care of to get the property ready for rental? Consider the current condition and calculate potential renovation costs.

7. Ensure Recent Repairs Follow Code

If the previous owner remodeled the house, make sure they did the work to code. If not, you’re responsible for getting it up to city requirements. This could mean complete demo on work that looks great but will have to be redone if it wasn’t up to code.

Those expenses add up quickly. If you need to demo an entire addition or break the concrete slab of the house to get to a cracked pipe, for example, you could be looking at repairs costing tens of thousands of dollars.

8. Plan for Ongoing Repairs

Who will handle ongoing repairs once the house is rented? Do you know someone you trust that can do the work quickly?

9. Market to the Right Tenants

The success of a rental property depends on finding good tenants who take care of your home.

10. Vet Potential Tenants

Do you have a process for vetting potential tenants? Plan an interview and referral process that lets you establish rental history, and choose a tenant who will take care of your property and pay rent on time.

11. Establish a Process to Collect Rent and Enforce Late Fees

How will you collect rent? How will you handle late fees? Be proactive in your rent collection procedures so tenants know how to pay and what to expect if they don’t.

12. Plan to Manage Tenants

How will you handle hostile tenants? How do you ensure tenants won’t destroy your property? When there’s a breach of contract, you need an action plan for handling it.

13. Legal Regulations

Both local and federal laws factor into investment properties. Without a proper understanding of your obligations and the tenant’s rights, you’ll easily find yourself in a legal mess. Before you buy, make sure you legally protect yourself.

Share this Image On Your Site

14. Register the Property As a Rental

You can’t rent your property without the proper paperwork and inspections. Research the local process and regulations for rental property registration.

15. Set Up an Account for Security Deposits

Security deposits must be kept in an escrow account separate from all other funds. Plus, the law is very specific about when and how these funds can be used.

16. Understand How and When to File an Eviction

What justifies eviction? What warning should a tenant have before you file? When can you re-key the property? No one wants to file evictions, but you need to know how in case it’s necessary.

17. Understand How to Apply Rental Funds on Past Due Balances

Do you know how to prosecute a tenant that owes you money? Do you know what fees you can charge? Texas law allows you to charge a violation fee for past due balances, but not every state does.

Considering A Tenant-Occupied Rental? You’ll Also Need These Items

1. Rental Application

Without the rental application, you’re unable to send the tenant to collections. You’re also unable to evict the tenant, in the case of of non-payment of rent, because you don’t have their drivers license, social security number, or birthday.

2. Residential Lease

You’ll need to know the existing lease term, monthly rent, security deposit amount, late fees, required time for a notice to vacate, and many other important details – all located in the residential lease.

3. Inventory & Condition Report

Without this report, you won’t know the condition of the rental property prior to taking possession. And without this information, there’s no way to hold a tenant responsible at the end of the lease for any damage done to the property.

Note: When you take over a tenant-occupied property, you will not be able to complete the security deposit itemization without an Inventory & Condition report. At LEAP, we require this report to be signed by both parties, and we also include move-in photos to back up the report.

4. Before Move-In Photos

As mentioned above, these photos provide extra proof to support the Inventory & Condition report.

5. Lease Violations (If Applicable)

If there are any recurring issues with a tenant it’s important to get this information when taking over the property. Are there multiple missed rent payments? Have they had issues with the HOA? Get those details upfront.

6. Owner & Tenant Ledger

The Owner & Tenant Ledger tracks revenue and expenses related to the rental property. It gives you an accurate account of cash flow, money spent for repairs, and missed payments, and you’ll want to have proof of this before taking over the property.

7. Completed/Pending Work Orders

These documents give insight to the work that’s been done on the property. Was there a flood that required new baseboards? When was the last time a particular appliance was worked on? Work orders tell you the story of the condition of the house, much like the vehicle history report before buying a pre-owned car.

8. Property Keys

This one seems obvious, but you’ll want to be sure you get a copy of the property’s keys so you have access to the home. Don’t rely on the tenant to give you access.

9. City Rental Application

Keep this application on file so you’ll know 1) that it was filed and you don’t need to do it yourself, and 2) when it needs to be updated.

10. The First Month to Collect Rent

When you’re transitioning ownership, it’s important to know if the previous property manager or owner collected rent or if you need to get it from the tenant. Make sure you don’t miss out on a month’s rent!

Don’t walk into an investment purchase blindly. When buying an investment property, checklists keep you focused on the many factors that help you make the best financial decision. Make sure you’re equipped for the responsibility investment properties require. And if it’s too daunting, a good property manager can handle these issues for you.